What Best Describes the Discount on Bonds Payable Account

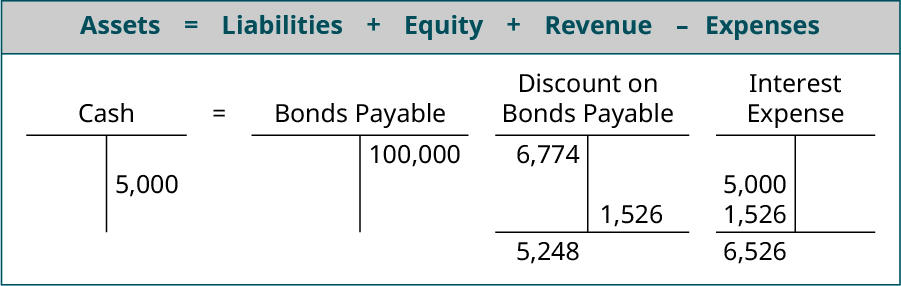

Who are the experts. Amortization of the discount on bondspayable account therefore increases the book value of the bond.

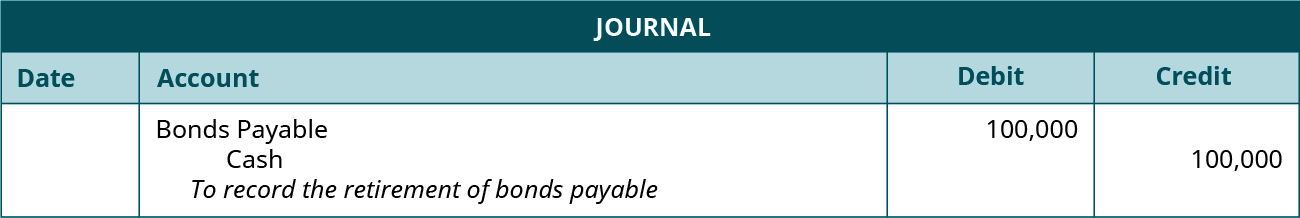

Prepare Journal Entries To Reflect The Life Cycle Of Bonds Principles Of Accounting Volume 1 Financial Accounting

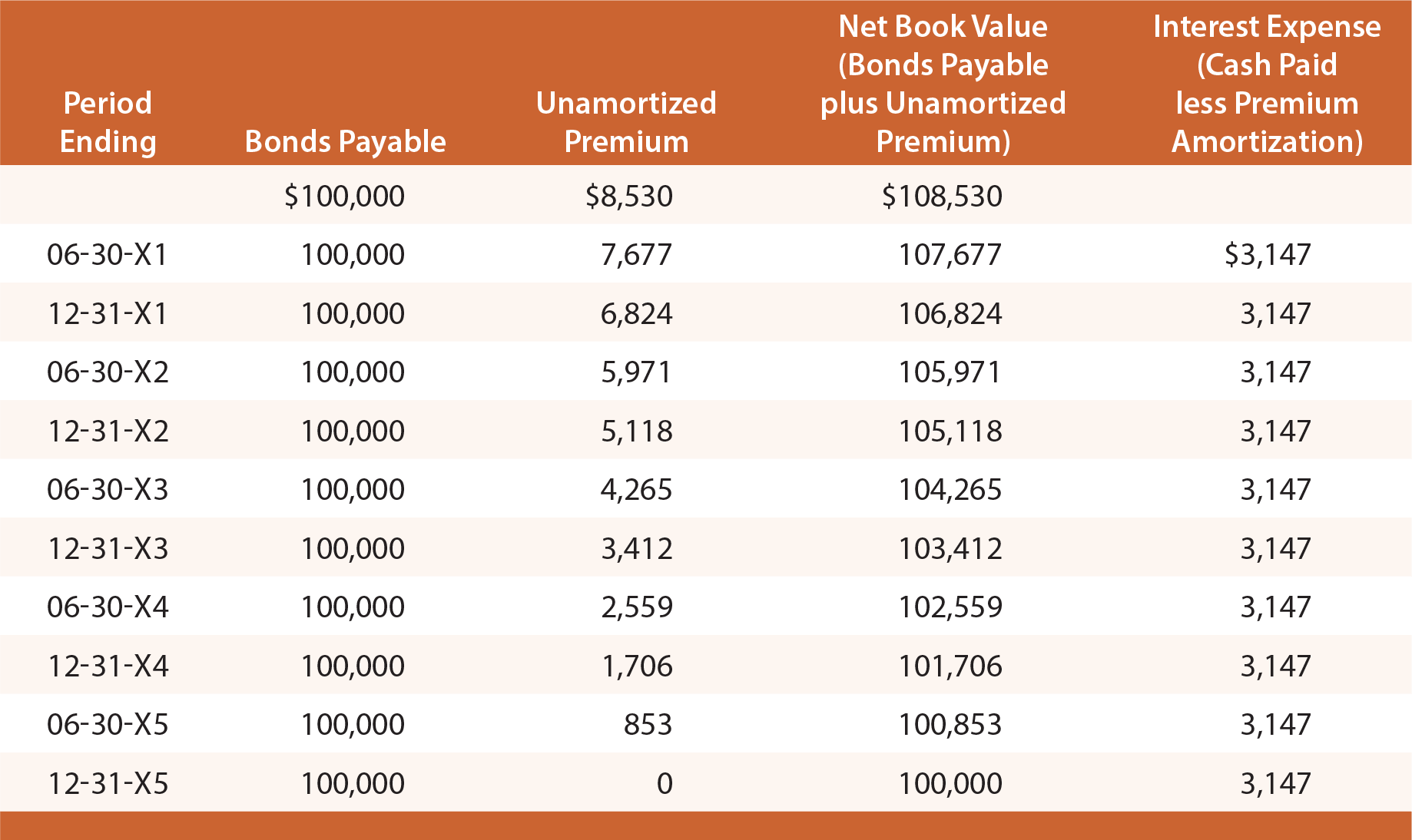

The bonds were issued to yield 10 percent.

. 9-4 What best describes the discount on bonds payable account. B market rate of interest was less than the stated rate at the time of issue. Face amount plus premium on bonds payable or minus discount on bonds payable.

The Bower Company sold 100000 of bonds for 95000. In the balance sheet the account Discount on Bonds Payable is Group of answer choices added to bonds payable deducted from bonds payable classified as a stockholders equity account classified as an asset. A discount on bonds payable occurs when the bonds par value is higher than the issue price or carrying value.

They need to debit bons payable 100000 Premium 926 and credit Cash 99000 Gain 1926. The recorded amount of interest expense is based on the interest rate stated on the face of the bond. The company paid its accounts payable more quickly in 2018 signaling a stronger liquidity position.

The premium on bonds payable is an account that appears only on the books of. The bonds sold at a discount. View the full answer.

The entry for interest payments is a debit to interest. Experts are tested by Chegg as specialists in their subject area. A discount on bonds payable is best described as.

Face amount minus bond issue cost D. Discounted on Bonds Payable. A 1000 bond sold for 10125.

Interest is payable semiannually on January 1 and July 1. A contra liability. Accounting for Bond Interest Payments.

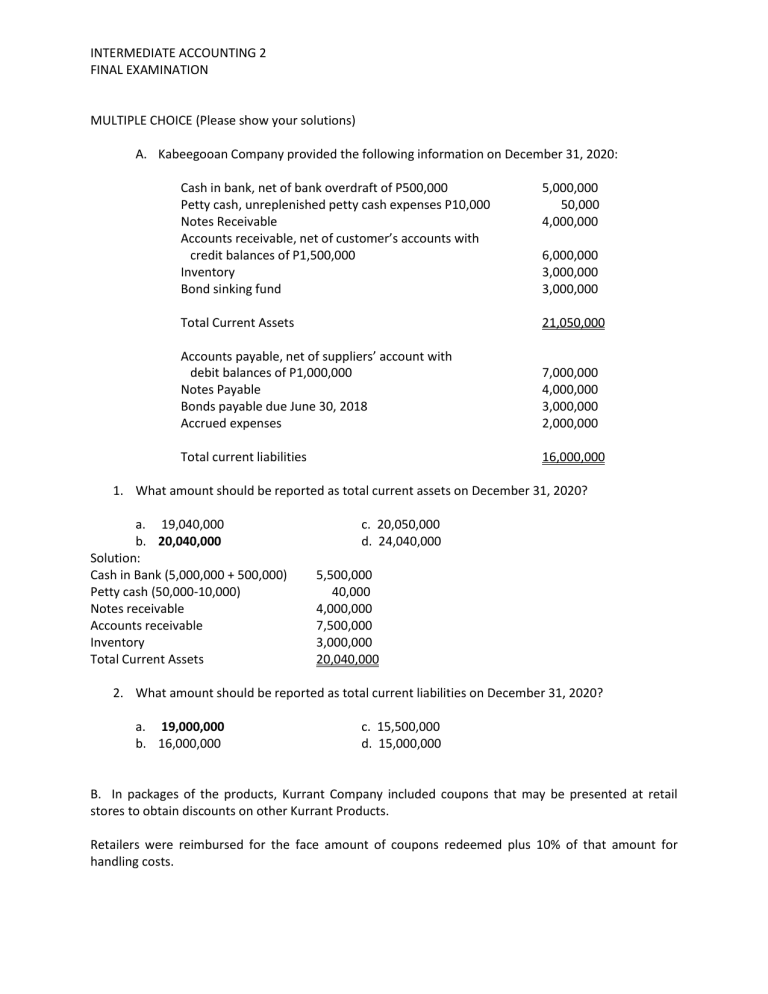

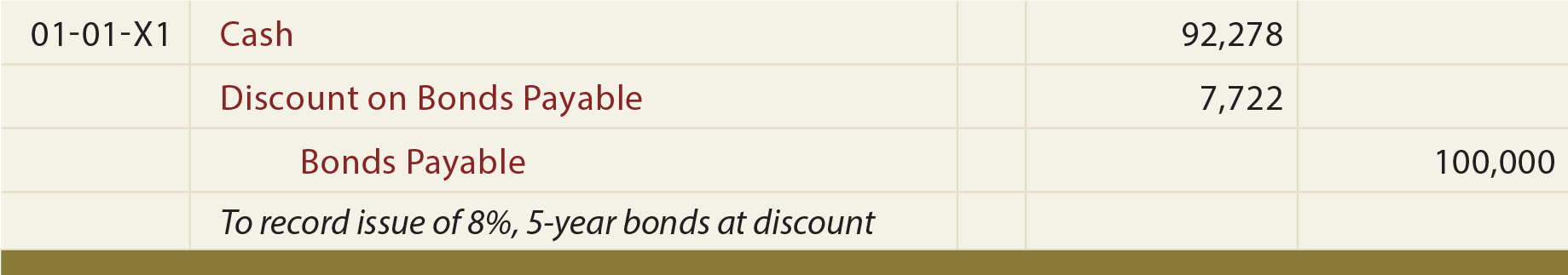

The difference between these two numbers is considered the bond discount. Cheryl Inc issued 100000 8 5-year bonds. Discount on bonds payable or bond discount occurs when a corporation issues bonds and receives less than the bonds face or maturity amount.

View full document See Page 1 116. Definition of Discount on Bonds Payable. The bond rate of interest is 10125 percent of the market rate of interest.

A contra liability account that reports the amount of unamortized discount associated with bonds that are outstanding. In other words a discount is the difference between the par value and the issue price when the issue price is lower than the par value. Discount on bonds payable definition.

Expensed when paid b. 100 6 ratings A contra liability account is an account where the balance is a debit balance in place of a c. We review their content and use your feedback to keep the quality high.

Income tax payable is found under the current liabilities section of a companys balance sheet. What best describes the discount on bonds payable account. Cheryl received 10113680 for the bonds.

What best describes the discount on bonds payable account. The discount on a. Which of the following best describes the accrual approach of accounting for warranty cost.

The debit balance in this account will be amortized to bond interest expense over the life of the. Using the effective-interest method how much of the bond discount should be amortized for the. Contra Liability The premium on bonds payable account is shown on the balance sheet as an addition to a long-term liability.

9-5 The premium on bonds payable account. If bonds are issued at 10125 this means that a 1000 bond sold for 10125 of par value. The Discount on Bonds Payable account.

The current market rate was 75. For example consider an investor that purchased a bond for 10150. A 1000 bond sold for 101250.

The bonds sold at a discount. If bonds are issued at 10125 this means that. The difference between the amount received and the.

Is a contra account to Bonds Payable. They buyback bonds at lower price than carry value the different is gain on bonds retirement. View the full answer.

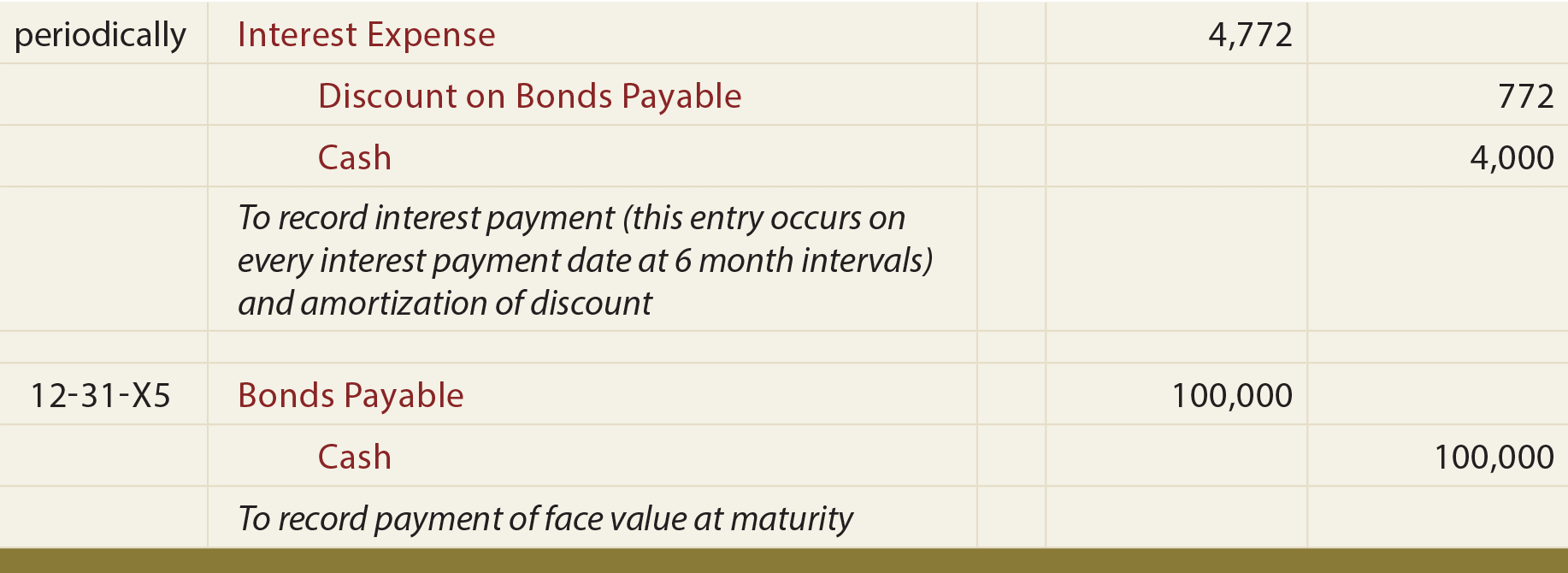

Journal Entry for Company C. Either straight-line or effective-interest amortization may be used for bond premiums or discountsregardless of the amounts involved. The bonds are dated July 1 2002 and mature on July 1 2012.

The discount on bonds payable originates when bonds are issued for less than the bonds face or maturity amount. It pays a 5 coupon rate semi-annually and has a yield to maturity of 35. The bond has a five-year maturity date and a par value of 10000.

BA bonus paid by the bondholders to the issuing corporation because of the unusually high interest rate stated in the bondsCThe present value of the future interest payments of bond interest and principal. 100 27 ratings The discount on bonds payable account is a contra liability account which is related. Which of the following statements best describes what this means.

The Discount on Bonds Payable account is. The discount on bonds payable is a contra-liability account. Any further impact on interest rates is handled separately through the amortization of any discounts or premiums on bonds payable as discussed below.

The root cause of the bond discount is the bonds have a stated interest rate which is lower than the market interest rate for similar bonds. The Discount on Bonds Payable account is. Discount on bonds payable C.

AAn element of future interest expense. The Discount on Bonds Payable account is. A 1000 bond sold for 101250.

Using the effective interest method of amortizing bond premium or discount the amount of interest expense for the first semiannual payment was.

Accounting For Bonds Payable Principlesofaccounting Com

Personal Financial Statement Personal Financial Statement Financial Statement Statement Template

Amortizing Bond Premium Using The Effective Interest Rate Method Accountingcoach

Chapter 14 Long Term Liabilities

Accounting For Bonds Payable Principlesofaccounting Com

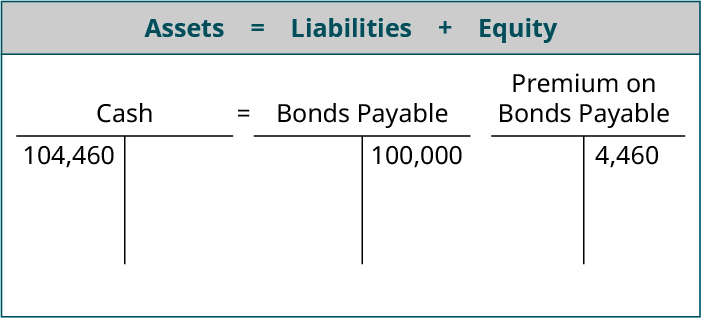

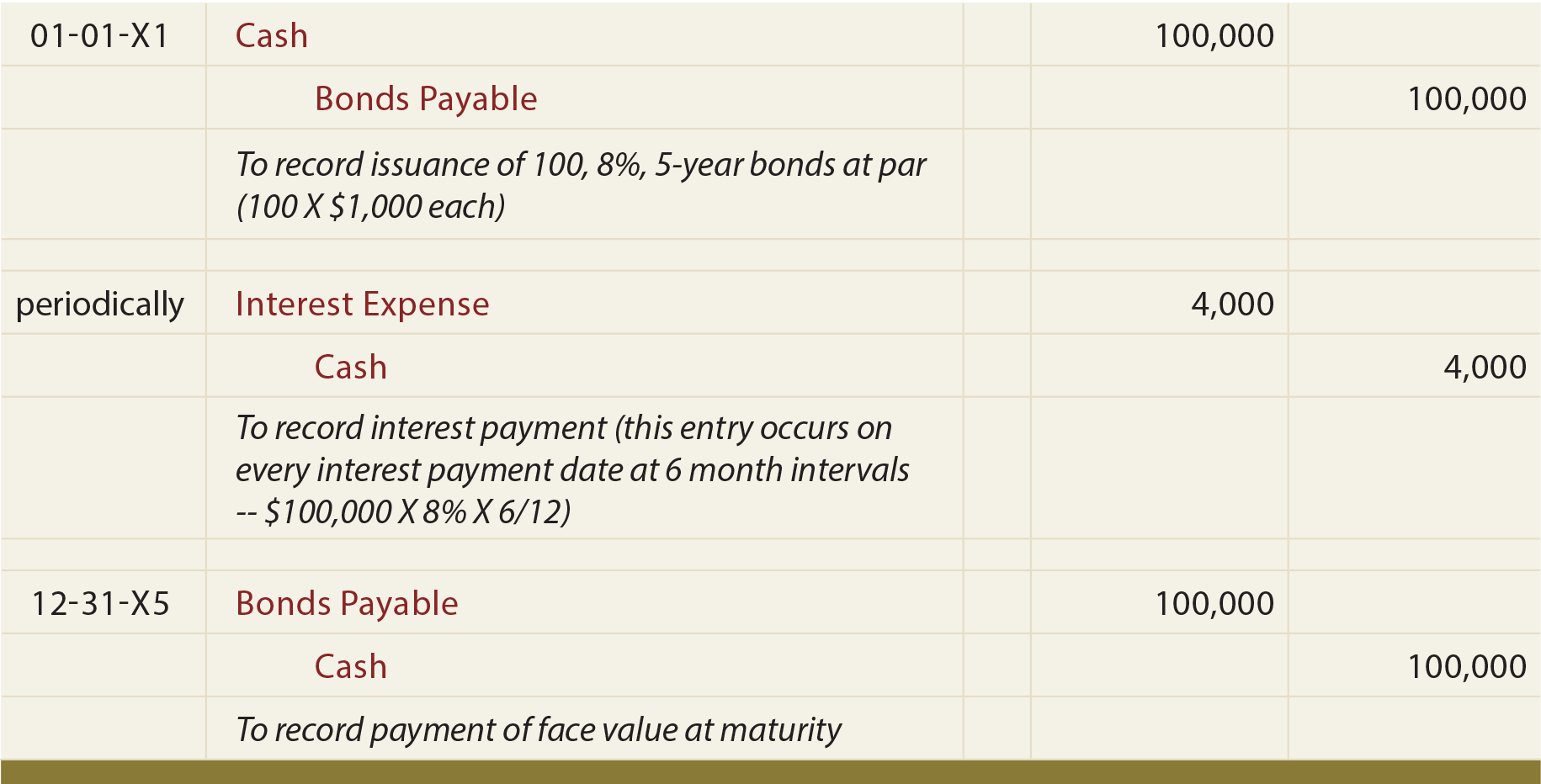

Prepare Journal Entries To Reflect The Life Cycle Of Bonds Principles Of Accounting Volume 1 Financial Accounting

Accounting For Bonds Payable Principlesofaccounting Com

2022 Cfa Level I Exam Cfa Study Preparation

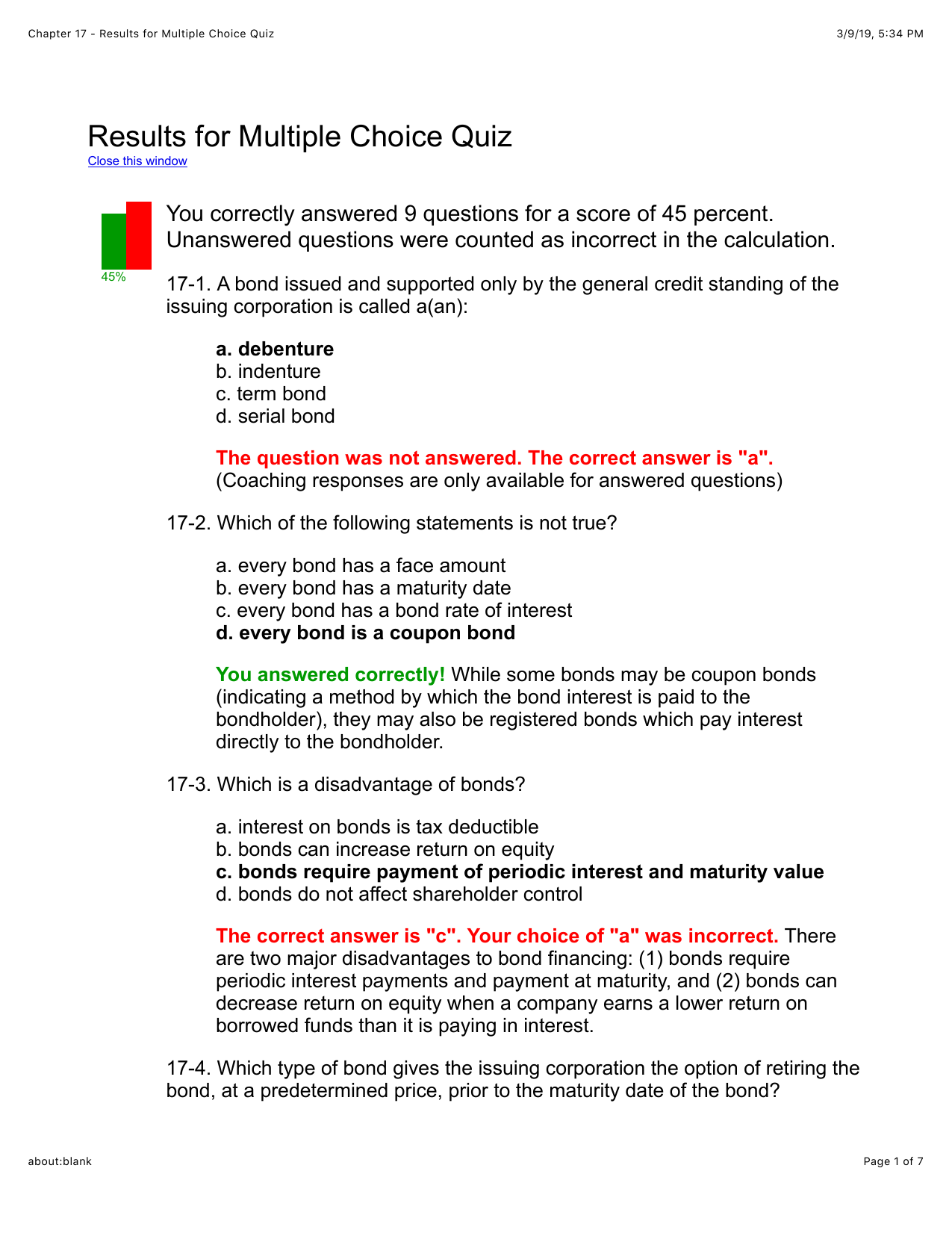

Chapter 17 Results For Multiple Choice Quiz

Balance Sheet Templates 15 Free Docs Xlsx Pdf Balance Sheet Template Balance Sheet Employee Handbook

Prepare Journal Entries To Reflect The Life Cycle Of Bonds Principles Of Accounting Volume 1 Financial Accounting

Prepare Journal Entries To Reflect The Life Cycle Of Bonds Principles Of Accounting Volume 1 Financial Accounting

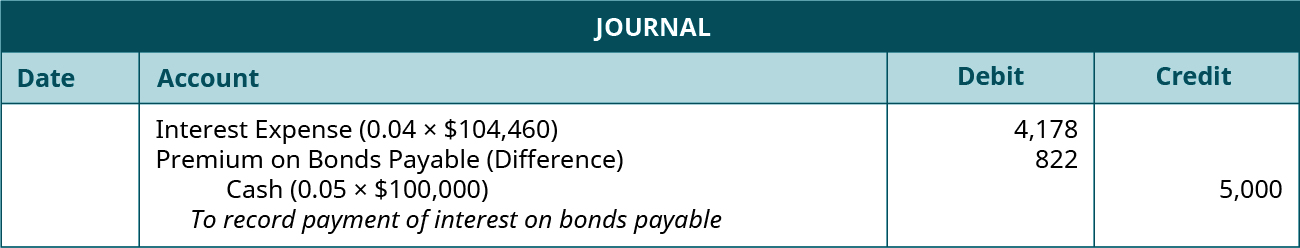

Amortizing Bond Premium Using The Effective Interest Rate Method Accountingcoach

Accounting For Bonds Payable Principlesofaccounting Com

Amortizing Bond Premium Using The Effective Interest Rate Method Accountingcoach

Amortizing Bond Premium Using The Effective Interest Rate Method Accountingcoach

Comments

Post a Comment